With healthcare costs and premiums on the rise, higher deductibles are one option to help control costs. And did you know that if you have a high-deductible medical plan, you can open a health savings account (HSA) that provides a tax deduction each time you fund the account? Deposits into an HSA are pretax and can reduce your taxable income.

Your employer may offer an HSA. However, if you are self-employed or can’t access an employer plan, your insurance agent can help you determine the best HSA for you.

What is a HSA?

An HSA reimburses you for medical costs such as copays, deductibles, dental expenses, or other costs your healthcare plan doesn’t cover. You or your employer funds the HSA, either through an employer benefit plan or through an account you open with a bank or with an insurer. Your money remains in the account until you incur an eligible medical expense. Then, when you use your debit card or check, or send the receipt to your account institution, your HSA will reimburse you for that expense from your account.

There are various types of HSAs to fit a variety of situations, including the flexible spending account and the health reimbursement arrangement, both of which are employer sponsored, and include various features and eligibility requirements.

If you’re going it alone, your insurance agent can describe various options and help you select the HSA that fits your goals.

An HSA is a great way to save for that rainy medical day and lower your tax obligations, as well.

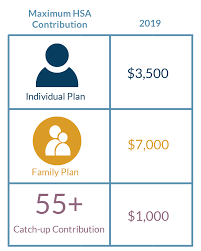

2019 Contributions limits are $3,500 for single, $7,000 for family, and a $1,000 catch-up contribution for those 55+